- Home » News » World News

Soaring steel costs are hitting motor prices and lead times

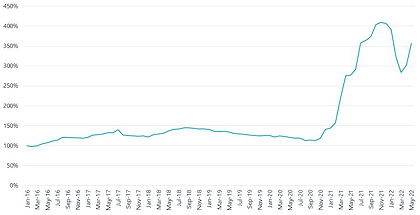

Mushrooming demand for electrical steels for use in EV (electric vehicle) motors is pushing up prices and lengthening lead times for industrial and commercial motors, a market analyst is warning. The price of cold-rolled electrical steels – which represent about 20% of the material costs of a motor – has soared by more by 400% since January 2016, according to Interact Analysis. This has contributed to a 35-40% increase in the average selling price of motors since January 2020 and further rises could be on the way.

In a recent blog, Blake Griffin, a senior analyst with Interact Analysis, warns that the rising price of electrical steels is likely to challenge motor vendors’ ability to produce machines “for years to come”.

The cold-rolled steel used for electrical steels makes up a relatively small part of overall steel demand. The production process is extremely capital-intensive and it takes a long time to increase production capacity.

Traditionally, motor manufacturers have been a major customer for cold-rolled electrical steels and have had little difficulty obtaining supplies. However, the growing demand for EV motors is undermining their bargaining power, Griffin reports. “As this trend progresses, it will impact vendor’ ability to secure the electric steel necessary for production, resulting in longer lead times, and higher prices for customers.”

Short-term Covid-related supply shocks have combined with the increased demand from the automotive sector to quadruple electrical steel prices. Griffin says that Interact has heard multiple reports of electric motor manufacturers having problems obtaining supplies of electrical steel because the steel suppliers are favouring automotive customers who are placing bigger orders.

Griffin calculates that if around a quarter of the 85 million vehicles produced globally in 2021 were electric, the number of motors needed would exceed the 19.2 million LV AC induction motors bought for industrial and commercial applications in 2021.

Interact expects the gap between supply and demand for electrical steel to widen over the coming five years, as production capacity lags behind the demand for EV motors. “This will ultimately result in supply shortages which will manifest in longer lead times and higher prices for motors,” Griffin warns.

The solution, he adds, lies in the hands of the steel producers. “More electrical steel needs to be produced to close the gap between supply and demand. We expect this to happen – albeit slowly.

“While the steel industry works to resolve this, we expect that motor suppliers which are more vertically integrated within their supply chains (particularly their steel supply) will begin winning share on the basis of lower lead times and lower prices, while the rest of the market struggles to secure the materials necessary for production.”

Interact Analysis: Twitter LinkedIn