- Home » News » World News

More than 500,000 robots shipped in 2023 as prices fell

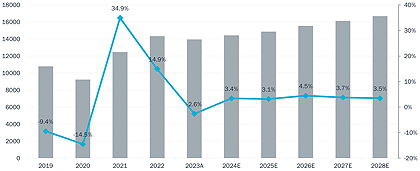

More than 500,000 industrial robots were shipped globally in 2023, according to a new report from Interact Analysis. This was a similar level to 2022, but the average price of industrial robots dropped last year, following two years of rising prices.

After the robot market hit a record high in 2021, 2023 marked a low point in terms of both revenues and shipments, but Interact predicts that revenues will recover and expand by around 3.7% per year between 2024 and 2028.

“We expect a price decline of around 3% per year between 2024 and 2028,” says Interact research manager, Maya Xiao. “The Covid-19 pandemic, coupled with high energy prices and inflation, caused an average price increase [of around 7%] in 2022.”

Interact originally expected robot prices to fall again in 2023, but supply chain and inflation issues resulted in prices creeping up to levels close to those seen in 2022. “This increased ‘price effect’ was also partially due to the market trend towards heavy-payload robots, which are materially a more expensive product,” Xiao points out.

“We can see from our data that the growth profile for industrial robots reflects the manufacturing slowdown during the pandemic era and the subsequent downturn in 2023,” she adds. “If we take a look at the manufacturing output figures for China, Europe and the Americas, the historic manufacturing contractions are synonymous with the decline in growth for the industrial robot market that we have observed in recent years.”

The top three industrial robot applications – material-handling, welding and assembly – accounted for more than 70% of robot revenues in 2023, with material-handling representing one third on its own. This application is particularly dominant in the Americas and Europe. The American market has the highest market concentration, with the top five suppliers accounting for almost 80% of revenues and more than two-thirds of shipments.

The Asia-Pacific region delivered almost two-thirds (62%) of global robot revenues in 2023, followed by the EMEA region on 22% and the Americas on 17%. The APAC region also saw a slight increase in growth in 2023, while the Americas plummeted by 17.3% and the EMEA region remained stable.

The industrial robot market enjoyed strong growth in the Americas after the pandemic in both the automotive and non-automotive sectors, with manufacturers looking for ways to improve their production processes and cut manufacturing costs. Sales of industrial robots to the automotive industry in the Americas faced significant pressure in 2023, resulting in sluggish growth. Mexico, in particular, has high dependence on the automotive sector, thus creating a greater impact on industrial robot sales in the region.

Interact Analysis: Twitter LinkedIn