- Home » News » World News

Surging prices drive LV motor sales up by 21% to $17bn

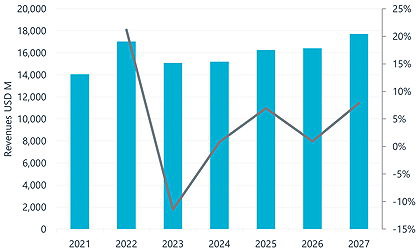

The global market for low-voltage AC motors soared by 21.2% during 2022 to hit a total of $17bn. According to the market analyst Interact, the main factor behind this rise was a 35–40% surge in motor prices during the first half of the year. However, it thinks that a slight price decline during the second half of the year will have had a knock-on effect on revenues and growth rates.

Interact expects prices to continue dropping during 2023, but the volume of motors being sold to remain high, matching the 2022 figures. It predicts that growth will slow, but will not fall, as the current economic climate and high interest rates are likely to influence demand for LV AC motors, particularly from the machinery sector.

The analyst has issued an updated report based on the unexpected rise in prices during 2022. “In our previous report,” says senior Interact analyst, Blake Griffin, “we expected prices to rise to a certain level and stagnate for a few years before declining. We have seen the opposite.

“The motor market is currently experiencing extreme price volatility and changes in the global economy, making forecasting very difficult,” he adds. “We can, however, confidently predict that prices will decline from 2023 onwards before they begin to stabilise in 2026/2027.”

The demand for motors tends to mirror the performance of the manufacturing sector. Interact expects the growth of the LV motors market to slow to around 0.29% in terms of unit sales during 2023, with revenues dropping by at least 10% as a result of falling prices.

Interact adds that the manufacturing sector is also likely to experience slow growth during 2023 as a result of high interest rates and the uncertainty caused by the Ukraine-Russia war. Many motor buyers are thought to have overstocked in previous years, and the market is now emerging from this period of high demand.

In the longer term, it predicts that 2026 will be a year of economic decline, affecting motor sales.

Legislation regulating the efficiency of motors continues to be a driving force for the EU market, with the adoption of IE4 motors having been “well received” according to the report. EMEA tends to produce the world’s highest priced motors, and the IE4 legislation has pushed prices up even further. It has also prompted other regions to raise their LV motor prices.

By 2027, almost 30% of revenues in the EMEA region will come from IE4 motors, Interact predicts. From 2023, all motors from 75-200kW will have be IE4-compliant.

The situation in the Americas is very different due to a lack of IE4 efficiency mandates, and average prices likely to remain stable until 2027. Currently they are just below those in the EMEA region.

The Asia-Pacific region currently accounts for the lion’s share of global LV motor revenues, but there is little legislation requiring IE4 motors. Most motors produced in the region are IE3-compliant and the area looks set to be the biggest market for lower efficiency motors in the period to 2027.

Interact Analysis: Twitter LinkedIn