- Home » News » World News

Motor prices soared by 14% in 2021 – and could rise further

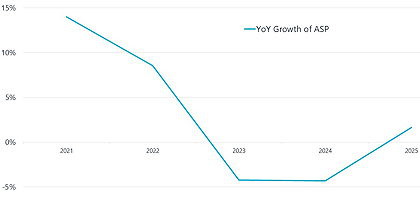

UPDATED: The average global price of low-voltage AC motors soared by 14% during 2021, compared to 2020 levels, and could rise by a further 8.5% this year, according to research by Interact Analysis. The biggest price rises last year were in the Americas and Europe, while the Asia-Pacific region, which is more resistant to price hikes, still saw prices rising by an average of 5.3%.

The higher prices helped to drive a 21.5% growth in revenues for motor vendors during 2021, taking the value of the global market to $14.6bn. The number of motors sold rose by a much more modest 6.6%.

Blake Griffin, a senior analyst at Interact, attributes the price rises to a combination of factors. He points out that price hikes in the AC motor market “far exceed the increases we’ve seen in many other markets we cover. For example, variable-frequency drive prices increased on average by less than 5% globally.”

Motor prices are closely tied to the cost of the raw materials – especially copper, aluminium and magnetic steel. Each of these experienced dramatic price increases during 2021. Supply chain shortages and delays were another factor in the motor price rises.

A further important element, according to Griffin, was the cost of energy, especially in China which produces much of the world’s supply of electrical steels. China took dramatic actions to protect its coal supplies, including limiting output in its energy-intensive industries such as steel production. As part of its effort to conserve energy and curb emissions, China also raised export tariffs on 23 steel products in mid-2021.

In late July of 2021, steel prices soared and motor vendors were forced to raise prices. Since then, steel prices have come down – due, in part, to the lifting of Trump-era tariffs on steel imported into the US – however steel still costs more than it did in 2020.

An important factor now is how severe this winter will be in Europe. If it is colder than average, Europe will have to import more liquified natural gas, constraining global LNG supplies and leading to heavier coal substitution. If this occurs, China’s already challenged supply will face even greater demand and could result in China again putting production caps on steel and other raw materials, leading to further price rises for steel – and for motors.

Interact Analysis is now predicting that the average selling price of LV motors will climb by 8.5% globally during 2022, partly as a result of increases in late 2021 that have rolled into 2022. Its forecast assumes that steel prices will rise again.

Griffin reports that the LV motor market is “undoubtedly stressed” by the price rises during 2021. The growth in motor shipments fell slightly below the rate for manufacturing production as a whole, indicating that the higher prices have a negative affected on demand for motors. However, with the rate at which revenues are growing as a result of the price increases, the lower shipments and higher prices could benefit motor vendors if their margins remain strong. “If so,” Griffin concludes, “higher prices could be on the horizon once again.”

Interact reports that ABB and Siemens continue to be the global leaders in the LV AC motor market, although Chinese manufacturers including Wolong Electric and Wanan Motors have entered the top ten of global suppliers. The analyst expects Wolong to become the top supplier in the Asia-Pacific region during 2022 – the first time a Chinese supplier has achieved this.

Although there has been considerable publicity for super high efficiency IE4 and IE5 motors, this is not translating into major sales yet, according to Griffin. “There is a lot of hype surrounding them, but the market has shown that it will generally not adopt them unless forced to by legislation,” he reports. “Currently, the IE4 and IE5 motor market is in its infancy with a market size of $134m in 2020.” This is less than 1% of the total global LV motors market. But Griffin expects substantial growth in sales of these machines in the European Union which is mandating IE4 minimum efficiency levels.

Blake Griffin has posted a fuller discussion of LV motor pricing in a blog.