- Home » News » World News

Global LV motors market ‘is set to shrink by 13%’

The global market for low-voltage motors will plummet by nearly 13% between 2015, when was worth $11.8bn, to 2017, when sales will total $10.3bn, according to a new assessment by IHS Markit. It says that sales of integral horsepower motors up to 690V have suffered since the third quarter of 2014 as the market has faced “numerous economic and political headwinds”.

Despite this “challenging” environment, the analyst sees opportunities for motor suppliers that can adapt to impending technological trends. For example, it says that motor users are increasingly interested in energy-efficient motors that will last longer and reduce lifecycle costs. As adoption of the Industrial Internet of Things (IIoT) accelerates, motor manufacturers are also starting to find ways to exploit this trend to offset weak sales, it adds.

“While there are reasons to be optimistic, the current political turmoil certainly harms growth prospects for the entire industrial automation equipment market throughout the next two-to-three years,” comments IHS Markit analyst, Preston Reine. “As the global economy adjusts and recovers from shocking events – such as the British exit of the European Union and stalling oil prices – the LV motor market revenue will decline very slightly, at a CAGR (compound annual growth rate) of –0.2% from 2015 to 2020. However, a strong recovery is expected to begin in 2018.”

While heavy industries that rely on oil and gas investments are not currently good areas for motor growth, there are still several industry sectors that have outperformed – or will outperform – the market average in the short-term. For example, IHS Markit expects the US housing and commercial construction markets to experience strong growth, which bodes well for motors sold into construction, infrastructure, and HVAC applications.

Fast-growing populations and rapid urbanisation mean that motor shipments to the food and beverage, water and wastewater, and power sectors will probably outperform the market average. In general, discrete manufacturing (machine-building) is predicted to perform better than process manufacturing.

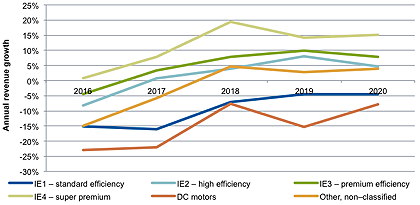

Sales of standard-efficiency IE1 motors are falling slowly. In 2015, they accounted for more than 26% of global LV motor revenues. This is expected to fall to 25% in 2016, and to 16% by 2020. These motors are sold mainly in the emerging markets that have yet to adopt efficiency regulations. However, many leading suppliers are still selling IE1 motors successfully in the US, Germany and other developed countries.

As demand grows for more efficient motors, IE2 (high efficiency), IE3 (premium efficiency), and IE4 (super-premium efficiency) motors will experience revenue CAGRs of 1.6%, 4.8%, and 11.3%, respectively, IHS Markit predicts. But with IE4 motors currently accounting for just over 1% of total motor market revenues, it will take a long time for this technology to capture a significant share of the market.

IHS Markit sees “ample” opportunities for motor manufacturers to maintain – and even to expand – their customer bases, by implementing technological advances. Acquisitions and strategic partnerships, in conjunction with increased research and development investments, have allowed the leading manufacturers to position themselves well for the future.

Even though the LV motor market is not currently thriving, today’s advanced technologies could be the norm for motor users in the near future, IHS Markit suggests – but only those motor suppliers that can adapt will be prepared for such rapid changes.