- Home » News » World News

LV drive price rises look set to continue as sales hit $14.2bn

Global semiconductor shortages continued to place strains on the low-voltage variable-speed drives market during 2022, affecting sales and pushing up prices of power modules to “staggering” levels – if they were available at all – according to a new report from Interact Analysis.

It says that some drives suppliers were forced to turn to the grey market as prices of some semiconductor components soared from $2–3 to as much as $40–50. This led to severe price volatility. According to Interact, the problems look set to continue because, despite some easing in the supply of microcontrollers, power modules are still difficult to source.

The LV AC Motor Drives Market 2022 report reveals that drives prices started to rise in the second half of 2021 and this continued into 2022, although the average selling price (ASP) around the world remained flat because of the distribution of price hikes, and shifts in the product mix towards lower-powered drives. Average prices rose by 6.4% during 2022 in the Americas, 3.3% in the Emea region, and fell slightly (by 0.5%) in the Asia-Pacific region.

Interact expects VSD prices to continue to rise during 2023, driven by a 7.3% increase in the Emea region as a result of the war in Ukraine, and a 0.4% increase in Asia-Pacific as a result of rising demand for drives with premium features.

“Compared with the last edition of the report,” says Interact research analyst, Brianna Jackson, “our outlook on pricing has changed, with price increases persisting in 2022 and stabilisation now expected to be some way of off in certain regions, as supply chain problems and semiconductor shortages continue. Our estimates of drive unit shipments, meanwhile, have been revised downwards to reflect a more realistic drive-to-motor attachment rate and a noted change in product mix.”

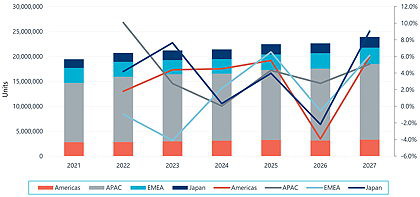

Strong sales of LV AC drives in the APAC region during 2022 resulted in the global market expanding to reach to an estimated total of $14.2bn. This growth was driven heavily by retrofits and by energy efficiency legislation in the APAC region. Order backlogs resulting from the Covid pandemic also fuelled the sector. However, the increased order intake did not lead to a rise in unit sales in all cases, because the supply chain problems affected the ability of some vendors to fulfil orders.

Despite extended Covid shutdowns in China, the number of drives sold in the APAC region – the world’s largest market – rose by 10.1%, boosted by backlogs and a steady growth in manufacturing output of 4.4%. Japan also experienced strong growth (4.2%) in unit sales during 2022. Growth in the Americas was more modest (1.8%), while Emea saw a decline, despite strong demand, as supply chain problems and the effects of the war in Ukraine (particularly on energy costs) affected manufacturing output and delivery rates.

Interact expects the Emea region to experience a revenue CAGR of 2.2% during 2023, with this growth coming mainly from price increases. It predicts that unit shipments will fall by 4.1% over the year because of the ongoing European energy crisis and declining order backlogs

Looking further ahead, the analyst expects revenues in the Americas to grow at a CAGR of 2.8% in the period to 2027, with growth slowing as prices moderate and the trend towards decentralised drives accelerates. It predicts that the APAC region will see a significant slowdown in growth during 2023 as order backlogs dry up, but average selling prices will pick up in the coming two years as a result of increasing demand for premium features, resulting in a revenue CAGR of 4% in the period to 2027.

Interact Analysis: Twitter LinkedIn