- Home » News » World News

Danfoss overtakes Siemens to lead EMEA drives market

Danfoss overtook Siemens in 2018 to become the leading supplier of variable-speed drives in the EMEA (Europe, Middle East and Africa) region, according to a new study of the global low-voltage AC drives market by Interact Analysis. ABB remains the global leader in a market where average drive prices fell by 2.7% compared with 2017 – a trend that the analyst predicts will continue.

According to the research, drives are increasingly being seen as a front-line for predictive maintenance, and as an enabler of the Internet of Things.

The report says that growth in the intralogistics and materials-handling sectors has led to an increased demand for decentralised and motor-mounted drives, and predicts that they will show the strongest growth over coming five years among the seven product types it covers.

Cabinet-mounted general-purpose drives account for nearly half of all global drive sales, but are also the slowest-growing type of drive product.

In regional terms, the Americas is predicted to be the fastest-growing drives market this year, while sales in EMEA are shrinking. China continues to dominate the global market, accounting for 43% of the drives shipped in 2019.

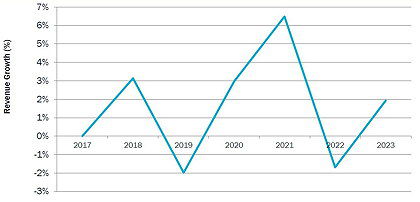

“In 2018, average drive prices fell by 2.7% compared with 2017,” says Interact Analysis’ CEO, Adrian Lloyd, “and we expect this trend to continue. To compound this, 2019 is experiencing a slowdown in the market. Yet the drives industry has reason for positivity. And not just because we expect the market to rebound in 2020.

“The world is becoming increasingly automated,” he adds. “Automation growth sectors, such as e-commerce warehouses, are creating vast new opportunities for drives. In the longer run, it is very positive for drives manufacturers that our research shows drives buyers increasingly seeing drives as the front line of predictive maintenance and industrial IoT.”

Interact Analysis claims to have pioneered a new forecasting approach that gives an “unprecedented” level of detail. For example, it can predict the anticipated demand for drives smaller than 2.2kW in the Indian packaging market.

“Most drives reports model industry dynamics by simply comparing the growth of the drives market with the growth of the entire manufacturing sector,” Lloyd explains. “Ours is different.” The company’s manufacturing industry output tracker compares the value of goods produced with the value of machines used to produce goods “to give a whole range of fresh new insights unavailable in any other drives report”.