Business rebounds for UK manufacturers, but problems not over

Output and orders have both rebounded for UK manufacturers during the first quarter of 2023 as domestic and global markets have improved, easing fears of a significant recession for the sector this year, according to a survey published by the manufacturers’ association Make UK and the accountancy and business advisory firm BDO.

The Make UK/BDO Q1 Manufacturing Outlook survey reveals a marked pick-up on the final quarter of 2022. The figures echo gradual improvements in other data such as the UK and European PMIs (Purchasing Managers’ Indexes) which are now only slightly into negative territory, as well as a strong pick-up in demand from China.

According to the survey of 338 companies conducted between 15 February and 8 March, the improvement is being driven largely by strong demand in the electronics and mechanical equipment sectors. The balance of orders in the electronics sector, in particular, is extremely strong at +64%.

According to Make UK and BDO, this could be due to several factors, including companies investing in digitalisation and extra capacity to counter labour shortages – or to take advantage of the final period of the super-deduction scheme which ends this month.

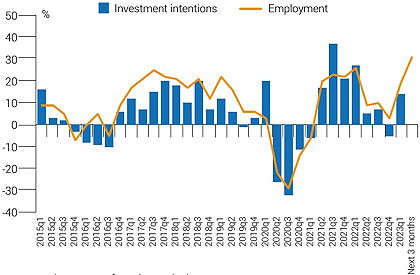

The survey also shows a significant improvement in investment even before the announcement on full expensing in the recent Budget. However, with the average investment cycle in manufacturing being around seven years, Make UK believes that for the measure to have a lasting effect on business investment, it needs to become permanent.

Despite the first-quarter improvement, Make UK and BDO are still forecasting a 3.3% contraction for manufacturing in 2023 (followed by growth of 0.8% in 2024), pointing out that the substantial challenges facing the sector show few signs of abating.

“Manufacturers have seen a rebound at the start of the year as conditions have improved in their major markets and, business confidence has improved,” says Make UK’s senior economist, Fhaheen Khan. “However, one swallow doesn’t make a summer and it is far too early to say the worst has passed, given the significant challenges the economy faces. However, the Budget should help boost investment in the short to medium term although, ideally, full expensing should be made permanent to better reflect the investment cycle for manufacturers.”

“Recent government announcements do very little to address the immediate threats to UK manufacturers resulting from the heavy burden of energy costs,” adds Richard Austin, BDO’s national head of manufacturing. “UK manufacturers need ongoing certainty on a range of fronts, including long-term energy costs, commitments and investment to develop UK giga-factories and support to attract a sustainable workforce. Manufacturers and investors need consistency and long-term support to build and shape their future plans around.

“The results of our research with Make UK illuminates that, despite glimmers of good news such as strong demand for electronics and mechanical equipment, inflationary pressures are still very evident for UK manufacturers with increased costs still being passed on,” Austin continues. “The data shows conflicting upward and downward indicators – potentially an industry at a crossroads. It will be fascinating to see which path will be followed over the coming months.”