- Home » News » World News

After falling for years, robot prices rose by 7% during 2022

Prices charged for industrial robots around the world rose during 2022 for the first time in many years. According to a new report from Interact Analysis, average selling prices for robots climbed by around 7%, largely as a result of continuing imbalances between supply and demand.

Many major robot manufacturers are still having delivery problems, Interact reports. Supply chain constraints are continuing into 2023, and the prices of raw materials and parts have not stabilised yet. “This has brought a lot of uncertainty to the market,” warns Maya Ciao, a senior analyst with Interact.

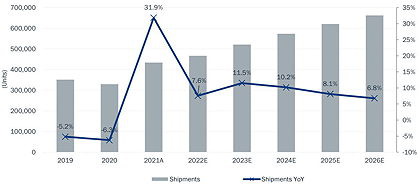

Despite the price rises, the global industrial robot market expanded by about 8% last year, although this is lower than lower that was being predicted at the start of the year. Interact attributes this growth to the combination of considerable order volumes during 2022 and rising demand from the manufacturing sector. It expects sales to grow by a further 7–9% during 2023. The Asia-Pacific market has recovered moderately, but the European market – hit heavily by the war in Ukraine and the subsequent energy crisis – is still finding growth more constrained.

Shipments of medium-to-high payload articulated robots rose by around 15% last year, driven largely by investment in automation for new energy vehicles and parts, batteries and logistics. But shipments of Scara robots fell slightly due to the weakness of the electronics industry. Sales of Scara robots with payloads loads above 20kg bucked the trend, increasing significantly however, because of their growing use in the battery manufacturing and material-handling sectors.

Collaborative robots (cobots) continued to be the fastest-growing technology during 2022, with shipments rising by 17% and sales by 20% – although from a relatively small base compared to more traditional industrial robots. Cobot prices were slightly higher than they had been in 2021. Interact expects global shipments of cobots to expand by a further 20% this year.

However, this growth rate is slower than has been predicted previously because of caution among SMEs, who account for a high proportion of cobot sales. Survival is their main priority, says Interact. They need to secure cash flow to manage the challenging climate, making them more cautious about capital investments. Although the analyst has lowered its forecast for cobot growth in the short term, it adds that in the long run, demand for automation is still “significant and stable”.

Interact predicts that the Asia-Pacific robot market will start to recover in the first half of 2023, with Europe following in the second half of the year and into 2024. It expects the industrial robot market to maintain an average annual growth rate of 5–7% over the coming five years.

The analyst does not anticipate full recovery from the effects of the Covid pandemic, economic pressures and supply chain challenges until 2024, with the US taking the longest to bounce back.

Interact Analysis: Twitter LinkedIn