Brexit-buying pushes UK manufacturing PMI to 37-month high

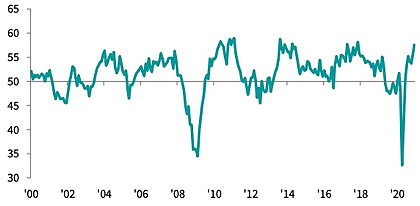

The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index (PMI) for the UK manufacturing sector hit a three-year high of 57.5 in December 2020 – up from 55.6 in November – boosted by customers bringing forward orders to beat the end of the Brexit transition period, and by the ongoing bounce from the re-opening of the global economy which increased new orders and pushed output higher. However, port delays and other disruptions meant that supply-chain delays were among the longest in the survey's history.

Output rose for the seventh month running, although to a lesser extent than the previous month. Job numbers in the sector fell for the eleventh consecutive month.

The survey, based on data collected from 4-18 December, shows new orders rising at the fastest pace since August, largely reflecting orders being brought forward to guard against potential disruption caused by the end of the Brexit transition period.

There was substantial disruption to manufacturers’ supply chains. Raw material shortages, port delays, freight capacity issues and Brexit concerns, all contributed to this disruption.

Average input costs rose at the fastest rate in 2½ years, reflecting input shortages, vendor price rises, higher transport costs, Brexit uncertainty and exchange rate factors. Manufacturers responded by increasing their output charges.

Business optimism fell slightly in December, with 56% of manufacturers expecting their output to rise over the next 12 months, compared to 61% in November.

“The Manufacturing PMI rose to its highest level in over three years in December, mainly reflecting a boost from last-minute preparations before the end of the Brexit transition period,” says IHS Markit director, Rob Dobson. “Customers, especially those based in the EU, brought forward purchases, boosting sales temporarily. It seems likely that this boost will reverse in the opening months of 2021, making for a weak start to the year.”

He points out that the December PMI data was collected before the French border was closed in response to the new variant of Covid-19, leading to further logistics and production disruptions for many companies.

“Worryingly,” Dobson adds, “the manufacturing sector was already beset by near-record supply-chain delays, even prior to the closure of Dover-Calais shipping. Manufacturers reported freight delays – especially at ports – plus shortages of certain raw materials and a lack of supplier capacity. Vendor lead times, a bellwether of supply-chain pressures, lengthened in December to a similar extent to during the first wave of the pandemic.

“UK manufacturers also built up input stocks to one of the greatest extents in the 29-year survey history in expectation of heightened logistics issues continuing during the first part of 2021,” Dobson continues. “If this is the case, as expected, the disruption to deliveries and production schedules, alongside the unwinding of Brexit inventories, may place the manufacturing recovery under greater threat in the coming months.”

CIPS group director Duncan Brock points out that new orders in the UK manufacturing sector during the last quarter of 2020 rose at one of the fastest rates since January 2018 as both UK and European firms stockpiled goods and materials in an attempt to avoid further disruption this winter.

“This rush to secure supplies meant already stressed supply chains paid the price with some of the longest delays in the near 30-year survey history,” he adds. “Bunged-up ports caused backlogs to rise to levels not seen for a decade and optimism for the year ahead dropped to a six-month low as the challenges for manufacturers just kept coming.

“After a severely turbulent year, UK makers still have a great deal to worry about,” Brock comments. “Job numbers continue to fall, and material shortages have resulted in the highest cost inflation since 2018. The sector is holding its breath until the terms of the new deal are fully understood and whether new business can be sustained in the same way in a post-Brexit marketplace.”