- Home » News » World News

Global sales of industrial robots go into reverse

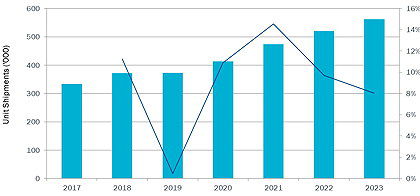

After several years of seemingly unstoppable growth, the global market for industrial robots went into decline during 2019, with revenues falling by an estimated 4.3%.

The slowing global economy, trade wars and uncertainty in the global automotive industry, have all played a part in the slowdown, according to Interact Analysis, but it predicts that sales will pick up again towards the end of 2020 and accelerate in 2021. It suggests that new applications, lower prices and wider use cases will lead to a significant upturn in the demand for robots by 2023.

“Automotive and smartphone production declines have played play a significant part in the downturn,” says Interact’s research director, Jan Zhang. “As the largest end-user segment for industrial robots – accounting for over 30% of revenues – any downturn in this area is keenly felt in automation and robot investment.

“Despite this,” Zhang continues, “there are reasons to be optimistic. Long-term drivers, both for industrial robots and for automation as a whole, remain very strong.”

The emergence of new types of robot types – in particular, collaborative robots – will fuel the expected growth. Cobots are being adopted by industries, such as food and beverage, logistics, packaging and life sciences, not traditionally associated with robots.

“Growth in these industries can’t fully compensate for the decrease in the automotive industry, but it does warrant optimism for the future,” says Zhang.

While Japan remains the biggest manufacturer of industrial robots, with an estimated 45% of global production, there has been significant expansion in production capacity and output in China. As well as inward investment from well-established robot-makers such as ABB, Fanuc, Kuka and Yaskawa, increasing numbers of Chinese vendors are entering the market.

“While it is true that the growth of industrial robot revenues has slowed down, the reasons for this are clear and, for the most part, beyond the control of the vendors,” Zhang concludes. “Despite this, however, there is evidence that the industry is diversifying and putting the foundations in place for significant future growth, making this one of the more exciting spaces to operate in.”