- Home » News » World News

Hitachi buys US robotics SI, JR, for $1.4bn

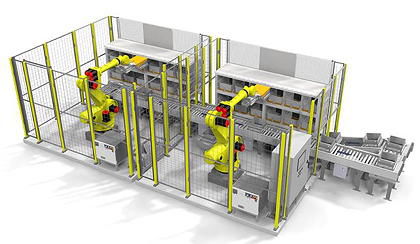

Hitachi is buying the leading US-based robotic systems integrator (SI), JR Automation Technologies, for $1.425m (around ¥158.2bn) to strengthen its factory automation activities in North America and elsewhere. JR, founded in 1980, builds production lines and logistics systems that use industrial robots. It employs more than 2,000 people at 23 locations worldwide and has expanded its revenues by more than 20% a year for the past three years to reach $603m in 2018.

The acquisition will take Hitachi into the fast-growing North American robotics SI sector, and accelerate the global development of its Lumada Solutions business which supplies digital services and technologies. It will also acquire JR Automation’s advanced technologies, know-how and resources, while JR will gain access Hitachi’s advanced r&d capabilities.

Hitachi executive vice-president, Masakazu Aoki, describes the acquisition as “an important milestone for us. By providing customers with new value that combines Hitachi’s products, OT, IT and advanced technologies, we will accelerate the global rollout of our social innovation business.”

JR’s CEO, Bryan Jones, that that “with our combined capabilities, Hitachi and JR Automation will be a uniquely qualified global leader in next-generation smart manufacturing, and this partnership”. He adds that the partnership “will enable us to continue to drive tangible value creation for our customers through innovative custom solutions”.

JR, whose headquarters are in Holland, Michigan, claims to be North America’s largest independent supplier of custom automation systems. It has customers in the automotive, aerospace, e-commerce and life sciences sectors. About 25% of its revenues are generated internationally.

Hitachi is buying JR from the private equity investor Crestview Partners which acquired JR from Huizenga Automation in 2015, when the business had $170m of sales and five production facilities in North America. It now has more than $600m of sales and 23 facilities worldwide.

Hitachi has set itself a target of achieving industrial business worth more than ¥130bn ($1.16bn) in North America, mainly through mergers and acquisitions. In 2017, it acquired the air compressor manufacturer, Sullair. It boosted its robotics SI activities earlier this year by acquiring the Japanese SI, KEC Corporation.

The JR acquisition is expected to close by the end of 2019.