- Home » News » World News

Collaborative robot market ‘will grow by 60% in 2018’

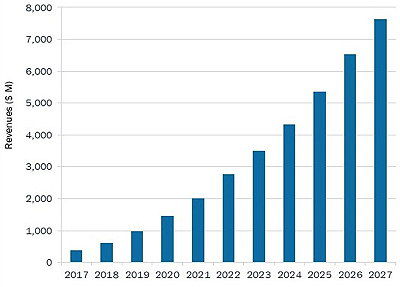

The global market for collaborative robots (cobots) will expand by more than 60% this year, according to an upcoming report from the market researcher, Interact Analysis. The industry was worth less than $400m last year, but will reach almost $600m in 2018, it predicts. Furthermore, growth is likely to accelerate in future due to the wider availability of cobots from mainstream industrial robot vendors, greater awareness of the technology among SMEs, and the wider adoption of cobots by major OEMs. The analyst predicts that revenues will reach $7.5bn by 2027, and will represent about 29% of the industrial robot market by then.

Many of the factors driving demand for collaborative robots are the same as for other automation products: a shortage of personnel; accelerating labour costs; shortening product cycles; and more diverse product mixes. However other factors also driving demand for collaborative robots include the need for greater automation flexibility, and the desire to save floorspace and eliminate safety fences.

Interact predicts that revenues will soar by more than 60% a year over the next two years, with a CAGR of more than 35% in the period to 2027.

Until recently, the uptake of cobots has been extremely fragmented. The largest customer base has been SMEs (small and medium-sized enterprises) who have been unable or unwilling to use standard industrial robots due to their size and costs, but can add cobots incrementally to automate their processes gradually.

Interact expects that SMEs will continue to drive growth in the near term, both because of increasing awareness of the technology, and because existing users are buying more cobots. It also predicts that adoption by major OEMs will accelerate rapidly in the coming five years, partly because collaborative robots are now available from well-known robot vendors.

The types of industry and applications that have been adopting collaborative robots are diverse. This is likely to continue, but Interact expects that applications will evolve in a similar way to industrial robots, with electronics and automotive being the largest user sectors. Both are already adopting cobots, with the electronics sector in particular benefitting from the high level of flexibility offered by cobots.

Despite the rapid sales growth, Interact warns that “all is not rosy for the suppliers of collaborative robots”. It points to the recent winding up of the cobot pioneer, Rethink Robotics, which, it says, highlights the challenges that the sector faces.

The market is still relatively small, yet is attracting an increasing number of entrants. The report identifies more than 30 vendors and more than 90 cobot products on the market at present – a large number given the small size of the market, it says.

Coupled to this is the challenge of fragmented and diverse customer demand. Interact estimates that users are buying an average of 1 to 10 cobots per site, with most being at the lower end of this spread. This suggests that average sales per project are just $30,000–350,000 (again mostly at the lower end). Due to the infancy of the industry, considerable effort and investment will be needed to build up a sizeable businesses, Interact warns.

Although most cobot manufacturers do not sell directly to end-users – relying instead on distributors and integrators – the fragmented demand is still placing “huge demands” on the manufacturers for support.

Universal Robots continues to dominate the cobot industry – Interact estimates that it held a 46% share of the market in 2017 – but new suppliers are continuing to emerge. Most are from China or Taiwan and have often spun out of other ventures, or from large robot vendors. Both are likely to make the industry more competitive, and “it is inevitable that weaker suppliers will be unable to compete,” Interact warns.