- Home » News » World News

Global sales of industrial robots double in five years

A record 381,000 industrial robots were shipped globally in 2017 – 30% more than in 2016 – generating revenues of $16.2bn – a 21% increase on 2016. This means that the annual sales volume of industrial robots has soared by 114% over the past five years (2013-2017).

The figures come from the latest World Robotics Report published by the International Federation of Robotics (IFR). It expects the growth to continue and predicts that 421,000 robots will be sold this year (a 10% increase on 2017), and that around 630,000 industrial robots will be supplied to factories around the world by 2021.

Just five countries accounted for 73% of the industrial robots sold last year: China; Japan; South Korea; the US and Germany. China expanded its leading position and bought around 138,000 industrial robots – 36% of all the industrial robots sold worldwide in 2017. China bought 59% more robots than it did in 2016, and more than the whole of Europe and the Americas combined (112,400 robots). Foreign suppliers increased their sales in China by 72% to 103,200, including robots made locally in China by global robot suppliers. This is the first time that foreign robot suppliers have outstripped the growth rate of local manufacturers. The market share of Chinese robot suppliers dropped from 31% in 2016 to 25% in 2017.

Japan’s robot-makers delivered 56% of the global supply in 2017, making the country the world’s leading manufacturer of industrial robots. Sales in Japan rose by 18% to 45,566 – the second-highest ever for the country.

Robot installations in the US hit a new peak in 2017 – for the seventh year in a row – with 33,192 robots being sold. This is 6% more than in 2016.

In Germany – the world’s fifth-largest robot market – the number of robots sold rose by 7% to 21,404, compared to 2016 (20,074 units). This ended a period of stagnation from 2014 to 2016, when annual sales were stuck at around 20,000 robots.

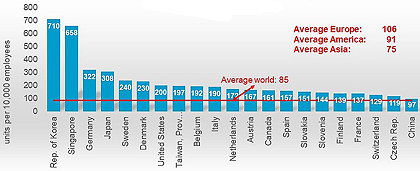

The Republic of Korea continues to have the highest robot density in the world with 710 robots per 10,000 manufacturing workers – more than eight times the global average of 85. But the number of robots supplied fell by 4% to 39,732 during 2017, mainly because the electrical/electronics industry cut its number of new robot installations by 18%. The year before, installations had peaked at 41,373.

Not far behind Korea in terms of robot density is Singapore with 658 robots per 10,000 workers, followed by Germany on 322, Japan on 308, Sweden on 240. The US has 200 industrial robots per 10,000 workers, and China has 97, making it 21st in the global league. The UK, where 2,334 industrial robots were sold during 2017, does not appear in the top 20.

The automotive industry is still the world’s largest user of robots, accounting for 33% of sales in 2017 – a 22% increase on 2016. The IFR expects automotive manufacturers to invest in collaborative applications for final assembly and finishing tasks in future. Second-tier automotive parts suppliers have been slower to automate, but the IFR expects this to change as robots become smaller, more adaptable, easier to program, and less capital-intensive.

The electrical/electronics sector has been catching up with the automotive sector in its use of industrial robots. Sales increased by 33% during 2017 to hit a new peak of 121,300 – representing 32% of the total global supply. The expanding range of smart end-effectors and vision technologies is extending the range of tasks that robots can perform in the manufacture of electronic products.

The use of robots in the metal and industrial machinery industries, soared by 55% in 2017 and now accounts for around 10% of the global market. Analysts expect this growth to continue, driven partly by the high demand for cobalt and lithium for electric car batteries. Large metals companies are implementing Industry 4.0 automation strategies, including robotics, to reap the benefits of economies of scale and to respond quickly to changes in demand.

The use of industrial robots in the food and beverage industry grew by 19% last year, with around 10,000 new installations worldwide. The IFR expects this growth to continue, driven by the shift towards shorter production runs.