- Home » News » World News

ABB’s $2.6bn GE deal will make it global switchgear leader

ABB’s recently announced acquisition of GE Industrial Solutions will allow it to leapfrog ahead of Siemens to become leader of the global switchgear market, according to a research note issued by IHS Markit. The market analyst estimates that ABB was previously behind Siemens and slightly ahead of Eaton in its share of this market, and that the GE acquisition will move it marginally ahead of Siemens.

IHS Markit adds that the $2.6bn deal will also make ABB one of the world’s top three suppliers of low-voltage motor control centres (LV MCCs), overtaking Schneider Electric. ABB will also join Eaton as the leading supplier of LV MCCs in the EMEA and Asia-Pacific regions.

ABB plans to integrate GE Industrial Solutions with its Electrification Products (EP) division, with an expected cumulative one-time cost for integration and implementation of $400 million.

According to IHS Markit manufacturing technology analyst, Susanne Cumberland, the acquisition will fill some gaps in ABB’s electrification portfolio, as well as increasing its presence in North America, especially in LV contactors and LV MCCs.

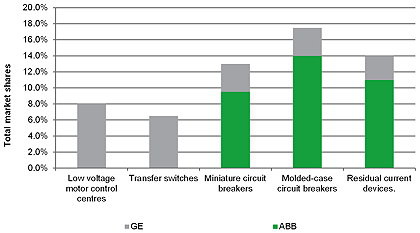

The acquisition will also have an impact on the global markets for other types of switchgear, such as MCBs (miniature circuit-breakers), RCDs (residual current devices), and MCCBs (moulded-case circuit-breakers). Cumberland anticipates that, overall, ABB will gain market share in the global switchgear market, putting itself marginally ahead of Siemens.

In the American switchgear market, ABB previously was one of the top five suppliers. The acquisition will give it a much bigger market share for two types of switchgear, in particular – LV MCCs (7%) and transfer switches (12.5%). The biggest change in the American switchgear market will be in LV contactors where ABB’s market share will go from 6.5% to 12.5%, making it the second-largest supplier, and closing the gap with Schneider Electric.

ABB’s CEO Ulrich Spiesshofer and chief financial officer Timo Ihamuotila have stated that challenges that GE was facing before the takeover included an aging portfolio, a declining share of the US market, and a below-peer margin. ABB’s focus after the integration will be to make the acquired business better before making it bigger. Spiesshofer plans to introduce ABB’s digitalisation technology into the acquired business to address the issue of the ageing portfolio.

Cumberland suggests that the decision to update this portfolio is important, coming at a time when Industry 4.0/IIoT is maturing in the industrial automation market.