- Home » News » World News

Robot sales slide in Germany, Japan and the UK

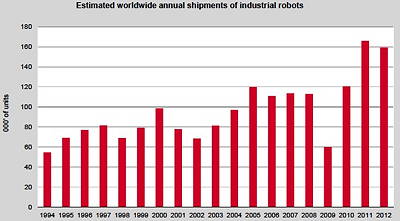

Sales of industrial robots will fall in Germany, Japan and the UK during 2013, according to the latest analysis by the International Federation of Robotics. However, worldwide sales will rise by 2% to reach 162,000, and the IFR expects global sales to climb by an average of around 6% per year between 2014 and 2016, creating a market for more than 190,000 robots by 2016.

The slowdown in key markets during 2013 is being attributed to a fall in demand from the automotive industry after three years of increasing installations in both traditional and emerging markets. Sales in Japan are also being hit by the continuing weak economic position of the electrical/electronics industry.

According to the IFR, the UK will also see a reduction in robot installations in 2013. In Italy, France and Spain, sales will decrease or stagnate.

Despite the short-term problems in particular countries, the IFR is optimistic about the longer-term future for industrial robotics. “The robotics industry is looking into a bright future,” says the organisation’s President, Dr Shinsuke Sakakibara.

The Federation expects sales to rise this year in North America, Brazil, the Republic of Korea, China and most other South East Asian markets, as well as in Central and Eastern Europe and in Turkey.

In terms of end-user sectors, IFR expects the electrical/electronics industry to increase investments in robots during 2013 as it increasingly automates production and retools for new production processes. The Federation also predicts increased orders from the pharmaceutical industry, the food and beverage industry, and the metal and machinery industry.

As more complex robot systems enter the market, the increase in turnover might be higher, as happened in 2011 and 2012.

Dr Andreas Bauer, chairman of the IFR’s Industrial Robot Suppliers Group, says that there is “huge potential” for further penetration of the segments such as electronics and food, and in the industrialisation of emerging countries. Further growth will come from the “breathtaking advanced and innovative technological developments” taking place in robotics. “These technologies are opening doors to completely new applications for robots,” he says.

Bauer cites developments in human-robot cooperation and opportunities in new fields for automation, especially in areas where robots are not being used currently.

Among the opportunities that the IFR identifies for industrial robots are:

• the continuing pressure to improve efficiency, which is driving higher levels of automation;

• the use of new and efficient materials, such as carbon composites, that need retooling;

• growing consumer demand that requires expanded production capacities;

• decreasing product lifecycles and increasing product variety which can be handled best using flexible automation;

• technical improvements – such as robots that are easier to use and collaborate with human workers – that will increase their use in general industry and in smaller companies; and

• the ability of high-tech robot systems to improve the quality of work by taking over dangerous, tedious and dirty jobs that are not possible or safe for humans to perform.

In its newly published World Robotics 2013 – Industrial Robots study, the IFR reports that between 2005 and 2012 sales of industrial robots to China increased by about 25% per year to reach 23,000 last year. This excludes sales by local Chinese robot manufacturers, who sold around 3,200 machines in 2012.

In addition, the Taiwanese company Foxconn Electronics is producing robots for its own manufacturing plants in China. The company has installed 10,000–30,000 robots in recent years. This means that total number of robots installed in China during 2012 was between 28,000 and 35,000, making it the world’s biggest robot market.

According to the IFR, the potential for automation in Chinese manufacturing industry is huge. Compared to countries such as Japan, Korea and Germany which have industrial robot densities of 270–400 per 10,000 employees, the robot density in China is just 20 robots per 10,000 workers.

However, the faltering economic growth in China may affect robot investments during 2013. Foreign suppliers expect to raise their sales by 5–10% this year, but from 2014 to 2016, this figure could reach 15%, with around 38,000 robots expected to be sold during 2016. Chinese robot manufacturers will also boost their production while foreign suppliers will increase their assembly of robots in China.