- Home » News » World News

Motion control sales rebound, with robotics in the lead

Following a significant decline in 2015, the global market for motion control products returned to solid growth in 2016, with more than $10.8bn of revenues from hardware, and more than 21 million systems being shipped. In a new study, the analyst IHS Markit predicts that the market will maintain a steady growth from 2016 to 2021, with a CAGR in revenues of 4.4%, to reach a global total of almost $13.4bn by 2021.

The GMC (general motion control) and CNC (computer numerical control) markets performed differently in 2016. Driven by growing demands from various end-markets, revenues for the global GMC market rose by 5% to reach a total of $6.9bn. However, the CNC market contracted by 2.9% to around $3.9bn, due largely to sluggish machine tool sales in the US and Japan.

The 6.6% depreciation of the Chinese renminbi and the 10.1% appreciation of the Japanese yen during 2016 affected revenues for the Asian and Japanese markets, which are presented in US dollars in the study.

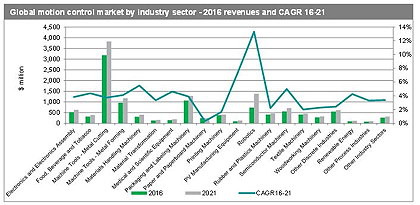

The performance of user industries – in particular, the machinery sectors – has a big effect on the motion control market. The machine tools market (including both metal-cutting and metal-forming) generated the largest revenues for motion controls globally in 2016, totalling more than $4.1bn. This sector is forecast to expand with a CAGR of 3.8% in the period to 2021 – slower than the market as whole.

Because machine tools dominate downstream uses for CNC systems, the sector’s slower-than-average growth results in a predicted revenue CAGR of 4.2% for CNC products, compared to 4.5% for GMC products, in the period to 2021.

IHS predicts that sales of motion controls to the robotics sector will overtake those for packaging machinery to become the second-largest global market, with revenues of $1.4bn by 2021. Robotic revenues are also predicted to be the fastest-growing, with a 13.3% CAGR from 2016 to 2021.

The increasing demand for motion control products is expected to come from sectors such as food and beverages, materials handling, medical equipment, photovoltaic equipment and semiconductor machinery. However, traditional automation sectors such as textile machinery, paper and paperboard machinery, printing machinery, and rubber and plastics machinery face various challenges which will result in them growing slower than the market average.