Industrial growth hits record highs, but NI hike could hit plans

UK manufacturers hit record levels of output and orders in the third quarter of 2021 and are set to recover almost all of the 10% decline in output they suffered during 2020, according to the latest Manufacturing Outlook survey published by the manufacturers’ association Make UK and the business advisory firm BDO, who are now predicting that the manufacturing sector will expand by 7.1% during 2021 – slightly down on their earlier forecast of 7.8%. The output volumes are the highest in the survey’s history.

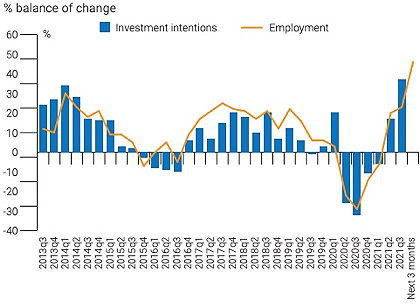

The growth is being driven by a surge in both domestic and overseas orders, which is now translating into strong hiring intentions. Domestic orders are stronger than export orders, suggesting that Brexit is still having an impact on trade with the EU.

Although the introduction of the “super-deduction tax” in the Budget earlier this year is prompting companies to invest, Make UK warns that the recent increase in National Insurance contributions threatens to choke off this boost, as well as hitting the prospects for recruitment, especially for young people.

Make UK stresses that the positive figures reflect a recovery from a very low base as a result of record falls in output in 2020, adding that supply chain disruption and significant labour shortages are now “widely evident” which could impact on the growth prospects for some companies for the rest of the year.

The survey of 327 manufacturers, conducted between 28 July and 17 August, also reveals significant increases in both domestic and export margins compared to the previous quarter. While positive for manufacturers’ profits, this highlights that companies are starting to pass on the increased costs of raw materials and shipping to end customers.

Assuming the Covid vaccines remain effective, Make UK expects manufacturing output levels to return to pre-pandemic levels by the end of 2022 – sooner than earlier forecasts had suggested.

“Growth prospects continue to accelerate for manufacturers as economies at home and abroad continue to open up,” comments Make UK CEO, Stephen Phipson. “However, supply chain shortages and the rapidly escalating increase in shipping costs are threatening to put roadblocks on the road to faster growth despite the current optimism.

“Furthermore, after surviving an 18-month pandemic, the recent increase in National Insurance was the last thing that industry needed, especially when firms need capital to invest and hire. Government should be putting in place measures to protect jobs and incentivise recruitment, especially for younger people.”

“The improved levels of investment we have seen for the second quarter in a row are hugely positive and are indicative of an industry that is confident of a future worth investing in,” adds BDO’s head of manufacturing, Richard Austin. “It feels like manufacturers are finally able to build some momentum, however the new levy has the potential to disrupt plans.

“Manufacturers have proved their resilience over and over again, but big challenges remain,” he continues. “Increasing costs, rising inflation and the ongoing battle to attract and retain skilled workers despite positive recruitment intentions will continue to stress-test UK makers for the remainder of the year.”