- Home » News » World News

Siemens sells Flender gears business to Carlyle for €2bn

Siemens is selling its Flender mechanical and electrical drives business to the global investment firm, The Carlyle Group, for €2.02bn. Further details of the transaction have not been disclosed.

The deal means that Flender will be returning to private equity ownership 15 years after Siemens bought it, along with the Winergy brand, for €1.2bn from Citigroup Venture Capital Equity Partners.

By selling Flender, Siemens says it is taking an important step in executing its Vision 2020+ strategy aimed at making it a more focused technology company. Carlyle says it plans to accelerate Flender’s growth and to develop its strengths by giving it more independence and greater leeway for decisions.

“By selling Flender, we’re successfully and rigorously continuing our strategy to become a new, focused Siemens AG,” says its president and CEO, Joe Kaeser. “Our plan of fixing the businesses ourselves by introducing the structures used in small and mid-sized companies has proven effective. Now it’s time to position Flender as an independent company and give it the chance to realise future growth opportunities. This fast decision gives customers and employees clarity and a solid foundation for planning.”

The sale means that Siemens will no longer pursue its original plan of spinning the business off and listing it publicly, thus offering a faster track to a clearer future for Flender.

“Our original plan was to list Flender on the stock exchange through a spin‑off,” explains Siemens’ chief financial officer, Ralf Thomas, who is also responsible for its portfolio companies. “Yet we’ve always been open for alternative solutions, too. The interest that numerous investors have taken clearly shows how attractive the company is and confirms the approach that we’ve been pursuing at our portfolio companies.

“The new ownership means that Flender will have the opportunities it will need in the future to optimise itself to an even greater extent and to address its customers’ requirements in an even more targeted way,” Thomas adds. “Siemens and its shareholders will, in turn, benefit from further business focus and the attractive valuation and the inflow of liquidity.”

As part of the sale, Carlyle has agreed to make long-term commitments to Flender and its employees. It says that using its “significant experience” in the industrial sector – in which it has already invested more than $20bn – it will support Flender to achieve its full potential as a standalone company, driving accelerated growth through operational and strategic improvements, including investment into its technology and service platform.

“As a global leader in gear and drive technology with a unique product and service portfolio, Flender is ideally positioned for further growth,” says Gregor Böhm, managing director and co-head of Carlyle Europe Buyout. “Our significant industrials expertise, as well as extensive experience with carve-out transactions, positions Carlyle well to support Flender with its continued growth and innovation. We look forward to partnering with the company’s management team and employees to further build on the company’s success.”

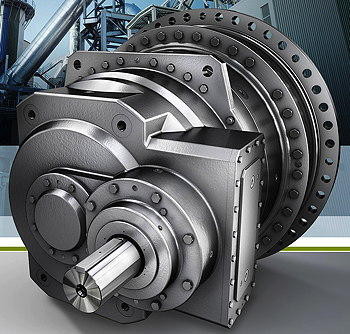

Flender, which was founded more than 120 years ago and is headquartered in Bocholt, Germany, supplies mechanical and electrical drive systems including gearboxes, couplings, generators and associated services. It employs about 8,600 people globally and generated around €2.2bn in revenues during the 2020 fiscal year.

It is particularly strong in the windpower sector, and is also active in other industries including cement, oil and gas, power generation, water and wastewater, marine, and conveyor and crane technologies.

“We are delighted to be partnering with Carlyle, a firm with a long history in growing industrials businesses globally and supporting companies as they transition to become standalone entities,” comments Flender’s CEO, Andreas Evertz. “We look forward to working closely together as we continue to serve our customers around the world while also pursuing our growth ambitions.”

One area where Carlyle sees a particularly strong future for Flender is the Asian windpower market. “We are excited by the significant growth opportunity of wind energy development in China and across Asia, where a significant proportion of the global capacity additions is expected to originate,” remarks Janine Feng, managing director of Carlyle Asia Partners. “We will draw upon our deep local presence to help Flender further solidify its competitive position in wind and industrial gears in the region, and to support the long-term development of wind power in Asia and globally.”

In April 2019, Siemens bundled several of its businesses together under the Portfolio Companies umbrella, and wants to give these companies more independence and autonomy, possibly involving changes of ownership.. The six businesses involved employ about 21,500 people and generate around €5bn in revenues.

The Flender transaction is expected to close in the first half of 2021 and is subject to foreign-investment and antitrust approvals.