- Home » News » World News

Profinet overtakes Ethernet/IP to lead networking market

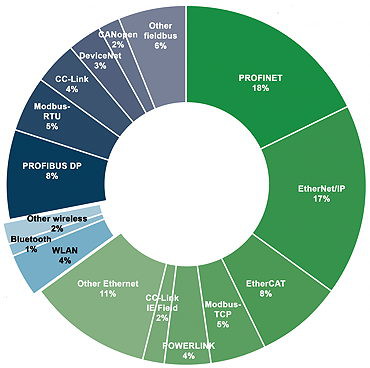

After battling to dominate the global industrial networking market for several years, Profinet has now overtaken EtherNet/IP to take an 18% share of the market, compared to the 17% held by Profinet. In its annual survey of the market, the industrial networking specialist HMS Networks also finds that wireless networking’s share of global sales has soared by 24% in the past year, although it still accounts for just 7% of the total market.

Despite the Corona pandemic, HMS reports that the industrial networking market is showing signs of stabilising and predicts that it will grow by 6% during 2021. Industrial Ethernet is still expanding by around 8% a year – faster than fieldbus technologies on 7% – and now accounts for 65% of all new installed nodes (compared to 64% last year).

Fieldbus nodes now hold 28% of the global market (down from 30% the previous year), but HMS also reports that fieldbuses have almost halted their decline of recent years, with the number of new installations dropping by just 1% during 2021. The company explains this by suggesting that in uncertain times such as during a pandemic, automation users tend to stick to known technologies. Profibus is still the clear fieldbus market leader, with an 8% share of the total market, followed by Modbus-RTU on 5% and CC-Link on 4%.

HMS' estimates of the number of new networking nodes installed for factory automation applications are based on its own sales figures and its perception of the market, combined with “insights from colleagues in the industry”. It defines a node as a machine or device connected to an industrial field network.

“Industrial network connectivity for devices and machines is key to obtaining smart and sustainable manufacturing, and this is the main driver for the growth we see in the industrial networking market,” says HMS’ chief marketing officer, Anders Hansson. “Factories are constantly working to optimise productivity, sustainability, quality, flexibility and security. Solid industrial networking is key to achieving these objectives.”

Although EtherCat has less than half the market share of either Profinet or Ethernet/IP, it continues to perform well globally and now has the same share (8%) as Profibus. Modbus TCP is the fourth-largest form of industrial Ethernet on 5% and, together with Modbus RTU, accounts for 10% of the total networking market.

Despite their 24% surge in market share, wireless technologies still represent just 7% of the industrial communications market. HMS points out that the market is still awaiting the full impact of 5G in factories. It expects that demand will continue to grow for wirelessly connected devices and machines to meet the needs of the less cabled and flexible automation architectures of the future.

Breaking down the market figures by regions, EtherNet/IP and Profinet are the leading technologies in Europe and the Middle East, with Profibus and EtherCat runners-up. Other popular networks in this part of the world are Modbus (RTU/TCP) and Ethernet Powerlink.

The US market is dominated by EtherNet/IP, with EtherCat gaining some market share, while Profinet and EtherNet/IP lead a fragmented Asian market, followed by CC-Link/CC-Link IE Field, Profibus, EtherCat and Modbus (RTU/TCP).

HMS Industrial Networks: Twitter LinkedIn Facebook