- Home » News » World News

5G connections are set to disrupt factory communications

There will be almost four billion wireless connections in smart factories around the world by 2030, according a new forecast from Nokia and ABI Research. It predicts that between 2019 and 2030, the market for low-power, wide-area (LPWA) LTE (Long-Term Evolution) wireless networking in factories will mushroom with a CAGR of 93.8%.

By next year, the study forecasts, there will be 9.1 million 4G connections globally. By 2025, this number will rise to almost 12m, but 5G will be gaining traction with 5.23m connections. And by 2030, 5G will dominate, with 344m connections in digital factories around the world.

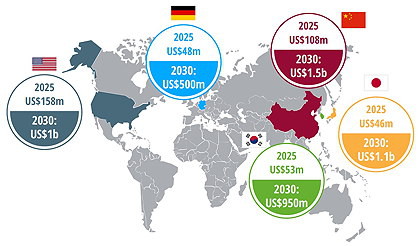

The value of this business will be substantial. Nokia and ABI predict that by 2030, revenues from wireless technologies used to connect machine tools will be worth $134bn, asset-tracking applications will be worth $78 billion, and connected PLCs will be worth $40bn.

As part of the study, Nokia and ABI quizzed more than 600 “manufacturing decision-makers” in nine industrialised countries and found that 74% of them want to upgrade their communications and control networks by the end of 2022, with more than 90% investigating the use of 4G and/or 5G in their operations.

The respondents were split almost evenly between the automotive, consumer goods and machinery sectors. The survey was conducted at the end of 2019, before the onset of the Covid-19 pandemic.

When asked why they were planning to invest in 4G or 5G technologies, 63% cited the need to digitalise and improve their existing infrastructures, 51% wanted to apply the technologies to automation and robotics, and 42% were looking to achieve new levels of employee productivity.

The research also examined the near-term drivers influencing buying decisions for new systems for both IT (information technology) and OT (operational technology) duties. The most important drivers were the desire to reduce downtime (cited by 53%), to improve operational efficiency (42%), and to enhance security (36%). OT drivers reflect the requirements to replace ageing infrastructure (43%), improve efficiency (40%) and increase capacity (38%).

According to the survey, the priority buying areas for cellular industrial technologies are: automation and machine upgrades (47%); IIoT initiatives (41%); and cloud infrastructures (37%).

“We have reached an inflection point in Industry 4.0 transformation as the fast, secure, low-latency connectivity underpinning its implementation is now becoming available,” suggests Manish Gulyani, vice-president of marketing at Nokia Enterprise. “This research indicates the strong appetite for industrial-grade wireless networking to capture the transformational benefits of digitalisation and automation. We believe that demand, combined with easy-to-deploy private wireless solutions, will drive adoption.”

The journey to wireless manufacturing faces several challenges, ranging from spectrum access being restricted by regulators, to the need for 5G specification bodies to firm up their standards. There is also the need to justify the capital expenditure to deploy private cellular networks. Defining use cases and quantifying them to justify the investment is “challenging”, the report states.

The survey shows that 84% of manufacturers that are considering deploying 4G/5G technologies want to operate their own local private wireless networks. This will allow them to use dedicated frequencies, run deterministic networks, and ensure the integrity of sensitive production data.

Ryan Martin, principal analyst at ABI Research, believes that the desire for private 5G networks is being driven by the need for security. “It’s evident that respondents are not entirely committed to Wi-Fi/WLAN and will consider latest generations of wireless technologies,” he says. “As a result, 2020 is a critical year for networking suppliers to educate the market regarding the merits of 4G/LTE and 5G.

“Based on this research, we also observe a pan-industry need to quantify not only the potential ROI of investing in private wireless, but also to clearly indicate the cost of inaction. Vendors need to make the case for investing in Industry 4.0 today to gain a clear competitive advantage over those who choose to wait.”