- Home » News » World News

Global IE4 motors market heads towards $300m

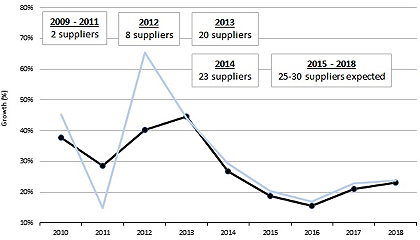

The global market for IE4 “super-premium efficiency” motors is expanding at double-digit rates and will more than double in size between 2013, when it was worth $115m, and 2018, when it will generate more than $297m in revenues. This prediction is made in a new report from IHS which also suggests that the number of suppliers of IE4 machines will soar from just two when the market emerged in 2009, to as many as 30 by 2018.

Although still relatively small compared to the entire global market for integral horsepower industrial LV motors, the IE4 market is attractive to motor suppliers because of the high profit margins they can achieve on these machines that usually incorporate high-priced raw materials.

IE4 motors have rapidly carved out a space in the high-efficiency market, even though the International Electrotechnical Commission (IEC) only defined the line-start, asynchronous version of IE4 motors in early 2014, and there is no government legislation yet mandating the use of these motors. Since 2009, the market has posted consecutive, double-digit growth rates and almost quadrupled in value in 2013 when nearly 259,000 IE4 motors were shipped.

Buying IE4 motors for use in industrial machines is currently a decision based purely on their high efficiencies and the rapid return-on-investment that they can provide in certain applications – particularly those with continuous duty cycles. In such applications, IE4 motors are displacing regulated high-efficiency motors to some extent.

Industrial pump and gearbox manufacturers have been “aggressive” in producing or procuring IE4 motors to sell with their high-efficiency equipment, IHS reports. It expects fan and compressor manufacturers to follow suit and enter the market by the end of the decade.

In 2009, two motor suppliers controlled most of the super-premium efficiency market, with both focusing on a neodymium-based magnet designs. By 2013, 20 suppliers, including traditional LV motor manufacturers as well as end-equipment manufacturers, had entered the market, bringing with them both new and established IE4 motor technologies. IHS predicts that up to ten more suppliers will launch IE4 products by 2018.

It expects growth rates in the IE4 market to slow down slightly in the period to 2016, before picking up again and exceeding 20% by 2018.