Automation will return to double-digit growth in 2010

Sales of industrial automation equipment during the first quarter of 2010 probably grew by 25% more than a year before, according to a new analysis by IMS Research. It expects an equally strong second quarter – buoyed by robust order books resulting from restocking and new orders – and predicts that even a flat second half of the year will result in close to double-digit revenue growth for most product areas.

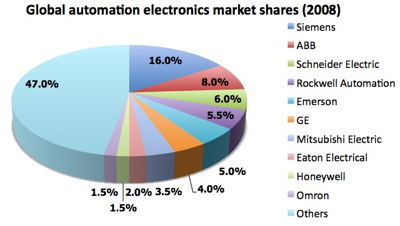

According to a new type of assessment by IMS – looking for the first time at the entire global market for industrial automation equipment, including motors – revenues dropped by around 14.3% last year to $74.9bn, from $87.4bn in 2008 (with market shares of the leading players shown below).

“This is the first time we’ve consolidated top-level findings from our entire automation portfolio into a single report,” explains IMS Research executive vice-president, Adrian Lloyd. “It’s quite astounding to see the size of collective revenues accounted for by this market.

“Not only have we consolidated key data from our own primary research, but also we have compared the results against indices generated from aggregates of quarterly filings of major, publicly-owned industrial electronic vendors,” he adds. “The two sets of data correlate very well, and have generated very interesting findings.”

After several years of rapid expansion accompanied by double-digit growth rates, the motors and motor control markets were battered by the economic downturn. However, these markets are poised for a substantial recovery in 2010, says IMS, with a return to double-digit growth in areas such as AC induction motors, DC brushless motors, motion control equipment, and AC and DC drives. The company expects these activities to help lift overall growth in the motors and motor controls market to more than 8% during 2010.

During the downturn, the market for low-voltage AC and DC drives, estimated to be worth $8.6bn in 2009, managed to outperform the market for low-voltage induction motors thanks, in part, to the energy efficiency benefits that drives can provide through retrofitting.

Unlike the motors and motor controls market, which benefits from a large retrofit business, sales of automation equipment such as PLCs, industrial PCs and I/O modules rely heavily on machinery production. Following an unprecedented contraction of nearly 20% during 2009, IMS predicts that machinery production will enjoy a moderate expansion in 2010, delivering a 7.6% growth in revenues for these types of automation equipment.

In 2009, the market for control equipment was worth an estimated $40.9bn, representing almost 55% of the total industrial automation electronics equipment market. IMS predicts that PLCs and I/O modules will both see double-digit growth rates in 2010.

Although IMS expects that most product markets will experience positive growth in 2010, it warns that project-based equipment markets will recover more slowly. It points out that equipment that depends on greenfield and brownfield projects tends to have longer lead-times and to lag the general economy.

Last year, while sales of most types of equipment were ccontracting, project-based equipment, such as medium-voltage motors and drives, and distributed control systems, continued to grow. But the impact of the recession is expected to be felt more profoundly in these areas during 2010.

During 2009, automation sales in the Asia-Pacific region were buffered by China’s GDP, which remained positive during the year. Following the region’s strong early recovery from the downturn, IMS predicts that it will expand by 9.6% in 2010 to become the largest regional market for industrial automation electronics equipment by 2011.

The market share estimates in the IMS study are based on 2008 revenues for industrial automation electrical hardware only, and exclude revenues generated through software and services or by mechanical systems.