- Home » News » World News

Emerson increases its bid for Rockwell from $27bn to $29bn

UPDATED: Following Rockwell Automation’s recent rejection of a $27bn bid from Emerson for its business, Emerson has increased its offer to $29bn. Emerson is proposing to acquire all of Rockwell’s shares for $225 per share, consisting of $135 in cash and $90 in Emerson shares.

But Rockwell's board of directors has rejected the latest bid, saying that it undervalues the business and its prospects, and presents a significant long-term risk for Rockwell shareholders. They also predict it would "create a company that is not well-positioned to compete successfully in the evolving market".

Emerson’s chairman and chief executive officer, David Farr, has written to Rockwell’s president and CEO, Blake Moret, arguing the merits of the new bid. “Over the past several months,” he says, “we have attempted to engage with you privately regarding a business combination of Emerson Electric and Rockwell Automation. We remain convinced there is compelling strategic, operational, and financial merit to bringing together our two companies – and that such a combination would benefit our respective customers, employees and shareholders.

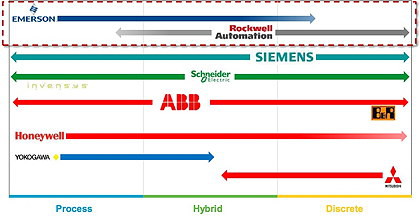

“The industrial logic for this combination is clear,” Farr continues. “A combination of Emerson and Rockwell would create a leader in the $200bn global automation market. Together, we could offer an unmatched technology portfolio that addresses customers’ current and future needs for a fully connected enterprise, where process, discrete, and hybrid work seamlessly together rather than relying on single, disparate platforms. By leveraging the key technology platforms that are the strengths of Emerson and Rockwell, we can create an industry leader with unmatched capabilities that integrates all aspects of the automation system for a global customer base. Competitors are already moving to provide integrated solutions. The combination of Emerson and Rockwell would accelerate our combined growth and position us for success for many years to come.

“Given our continued conviction in the significant value creation opportunity this combination represents,” Farr says, “I am sending you an enhanced proposal for Emerson to acquire Rockwell in a transaction that would provide Rockwell shareholders with immediate and long-term value that we believe is well in excess of what Rockwell could achieve on a standalone basis.

Farr contends that Emerson’s new offer “represents an attractive 30% premium to Rockwell’s undisturbed 90-day volume weighted average share price as of October 30, 2017, the day before our prior acquisition proposals became public.

“The portion of the consideration to be paid in Emerson stock would result in Rockwell shareholders owning approximately 22% of the combined company, allowing them to participate in the significant value creation from synergies generated by a combination,” he continues. “Based on public information only, we estimate the total capitalised value of synergies to be in excess of $6bn, which equates to over $1.3bn or $10 per share of additional value to Rockwell shareholders through their continuing ownership. Including the value of synergies, Rockwell shareholders would receive $235 per share in total value, representing aggregate value creation of 36% compared to Rockwell’s undisturbed 90-day volume weighted average share price as of October 30.

“The combined company would have increased scale across key end-markets, with approximately $23bn in annual revenue, supporting increased investments in software and technology and an acceleration of both top-line and bottom-line growth,” says Farr. “We expect the transaction would be accretive to adjusted EPS and free cash-flow in year one. Estimated synergies and enhanced operating efficiencies would result in an operating margin of approximately 20% as well as double-digit EPS growth. We will remain committed to maintaining an investment grade credit rating and expect the combined company to generate free cash flow of more than $3bn in year one, enabling additional strategic investment, rapid deleveraging and return of capital to shareholders through dividends and share repurchases.

“As outlined in our proposals, we would work with Rockwell to select a management team using a ‘best of both’ philosophy,” the Emerson CEO explains, “with significant roles for members of your existing team. This would provide the combined company with the greatest opportunity to succeed by enabling us to choose the right people for the right roles from both of our world-class organisations. We would expand our current Board from 10 to 13 directors, with three directors nominated from the current Rockwell Board. We would work with you to provide appropriate commitments to Rockwell employees and communities to ensure the combination is mutually beneficial to all of our stakeholders.

“As noted in our previous offers, we propose to name the combined company ‘Emerson Rockwell’ to reflect the legacies of our two companies,” Farr says. “We would also maintain a significant presence in Milwaukee as an ‘automation centre of excellence’ for the combined company. We look forward to engaging with you to identify additional ways to capture the absolute best of both organisations.

“We and our advisors have conducted extensive analysis of the regulatory approvals that would be required in connection with the proposed transaction, and we are confident that the transaction would receive all necessary approvals in a timely manner,” Farr reports. “We do not anticipate any material antitrust or other regulatory issues that would extend the normal timetable for closing a transaction of this nature. We strongly believe the combined company would be able to do more for our customers than either of us could do separately. We are confident that our common global customers will embrace the proposed transaction and, in fact, we have already received positive feedback from many of them about the potential market benefits that would result from a combination.

“Our proposal is not subject to any financing contingency. We have had in-depth discussions with JP Morgan, which is highly confident Emerson can finance the cash portion of the transaction with a combination of cash on our balance sheet and newly issued debt.

“We sincerely hope you and your Board will objectively evaluate the strategic, financial and operational benefits of this transaction and agree to meet with Emerson to negotiate a mutually beneficial transaction,” Farr concludes. “We, along with our advisors, Centerview Partners, JP Morgan and Davis Polk, stand ready to commence private discussions with Rockwell and its advisors. I look forward to your prompt response and to sitting down with you to discuss this unique opportunity for both of our companies.”

Rockwell Automation has confirmed that it has received Emerson’s revised unsolicited proposal to acquire its business. “As it did with Emerson's prior proposals, consistent with its fiduciary duties and in consultation with its financial and legal advisors,” it says, “the Board of Directors of Rockwell Automation will carefully review Emerson's proposal to determine the course of action that it believes is in the best interest of the company and Rockwell Automation shareowners. The Rockwell Automation board expects to respond to Emerson's proposal in due course.”